|

| By Nilus Mattive |

Although the Fourth of July weekend is over, tomorrow — July 8 — holds a much more important place in my heart.

That’s the day when my eighth-great-grandfather Henry Vanderslice — the Sheriff of Reading, Pennsylvania — rang a liberty bell in his town to let all the inhabitants know that the United States had declared its independence from Great Britain.

The bell is now on display along with a plaque dedicated to the event.

Henry didn’t stop there.

Even though he was 51 at the time, he joined the Continental Army where he served as a Wagon Master.

I found a diary of his exploits, which included riding with General George Washington …

Attacking British soldiers in Amboy, NJ …

And later supplying Washington’s troops with provisions during their long winter camped out in Valley Forge.

The final entry talks about the British leaving Philadelphia.

As it turns out, several other ancestors of mine participated in the Revolutionary War, too.

I guess a general distaste for government overreach and undue taxation just runs in my blood.

That’s why I like finding the very best strategies people can use to gain greater financial freedom and independence for themselves and their families.

Indeed, I’m actually surprised at how few Americans seem to remember exactly why my distant relative rang that bell back in July of 1776 …

Or what type of place the Founding Fathers hoped to create after the British left for good.

And make no mistake, money and freedom have always been tightly intertwined.

If the government is able to greatly erode your buying power through outrageous spending and poor fiscal policies …

Confiscate your wealth through unfair taxation …

Or completely turn off your ability to transact if they don’t like what you’re doing …

Then you are not free in any way, shape or form.

This is why, for thousands of years, gold has been the ultimate asset for anyone seeking autonomy, privacy and freedom from government overreach and largesse.

It remains so today.

But it is no longer the only option.

This is precisely why one of the first things I did when I took over Safe Money Report a few years ago was add an allocation to cryptocurrencies.

We started with Bitcoin … moved into Ethereum … and then eventually added exposure to other top-tier coins through a special fund called the Bitwise 10 Crypto Index Fund (BITW).

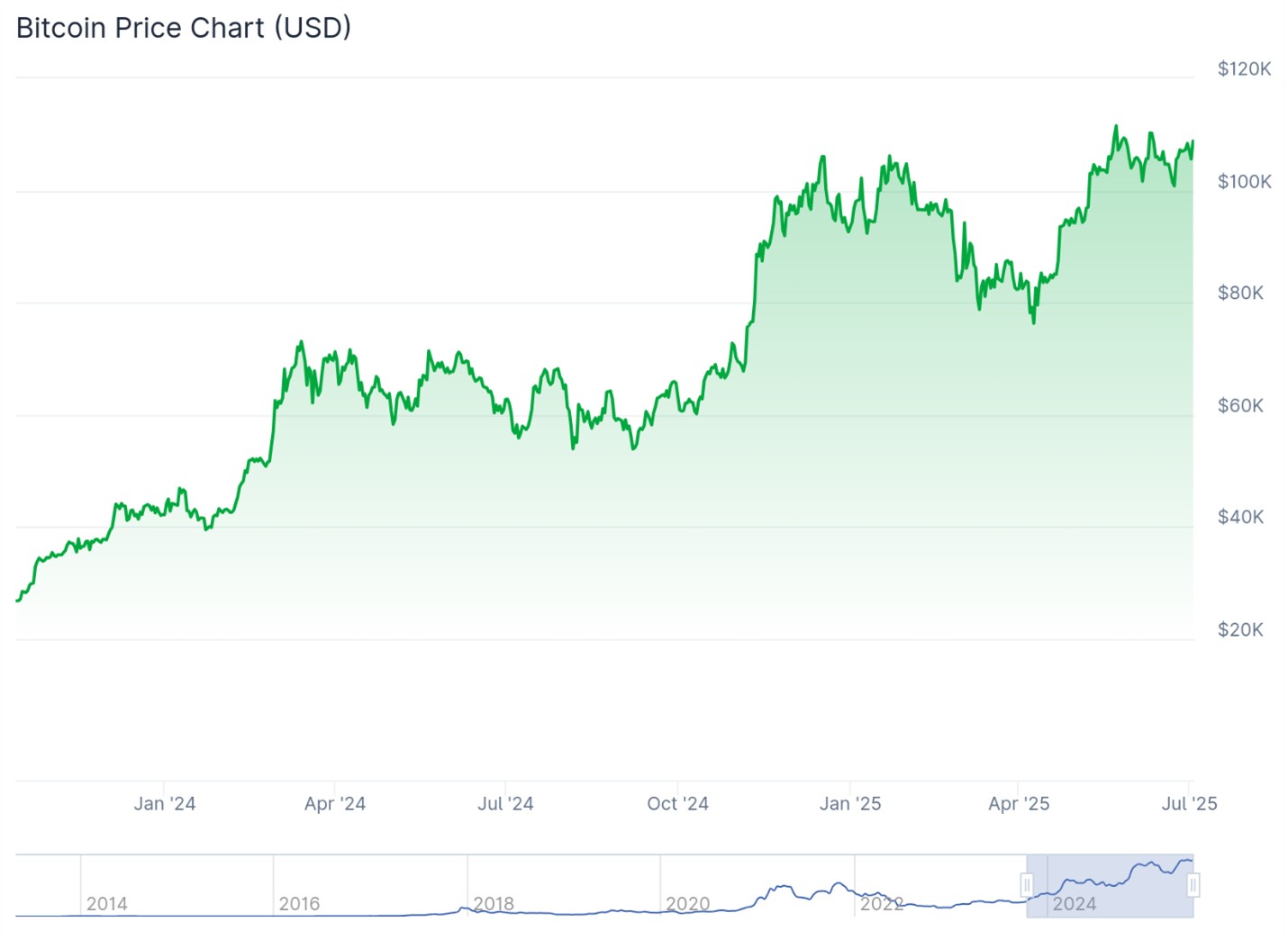

The results have been spectacular.

We initially booked quick double-digit gains on Bitcoin itself.

Then we banked triple-digit gains as high as 197% as special Bitcoin and Ethereum funds were converted into ETFs … giving us extra upside on top of the cryptos themselves.

Today we continue to hold allocations to those same two funds with open gains as high as 376% just since October 2023.

And now there’s talk that our Bitwise fund will be the next to convert to an actual ETF structure.

We previously booked a 66% gain on half of the position, and the remaining half is currently up 95%.

I think we will see even higher gains as this story keeps playing out.

Because here’s the bottom line: Cryptocurrencies provide yet another layer of diversification away from paper money and the traditional centralized financial system.

They may not act like short-term hedges in the traditional sense.

But their longer-term protective power is getting more evident with each passing year.

Henry Vanderslice rang bells, read paper documents and owned gold.

But if he were here today, I’m pretty sure he would own some crypto, too.

Best wishes,

Nilus Mattive

P.S. Another really cool aspect of cryptocurrencies is the potential for income — something that’s hard to get from gold.

In fact, since this is still such an overlooked income opportunity, we’re hosting a special “High-Yield Summit” later today.

At 2 p.m. Eastern today, you can join this summit to find out how to “Profit Like a Bank.”