|

| By Nilus Mattive |

I have been predicting a U.S. recession for quite a long time now. Way before any hint of one actually showed up anywhere in the data.

Indeed, every time I mentioned the possibility to friends and colleagues, that was always the criticism that came back — there was simply no “proof” recession was imminent.

That’s the problem with recessions. (Other than the economic havoc they wreak.)

By the time we start getting hard data about a contraction, it’s already too late.

Heck, based on the classic definition of a recession — two consecutive quarters of economic contraction — we can’t actually declare one until it’s well underway or already over!

So, what made me think we would see one before the signs were there?

Simple: The Fed’s aggressive interest-rate hikes. These tightened the massive amount of money sloshing around in the financial system.

For example, at the end of 2023, I wrote:

“For roughly two decades, the financial markets have become entirely used to virtually ‘free money.’

“What kind of damage has that already done? What systemic risk has been created?”

I then explained …

“It remains to be seen how much damage to the U.S. economy and financial system has already taken place — that’s because there is a severe lag between higher rates and their effects in the real world.”

And I outlined a roadmap that has proved completely accurate so far …

“My current belief is that the Fed will continue pushing a ‘higher for longer’ agenda — at least in name — until something seriously breaks.”

What comes next? I said back then …

“At that point, we will see a very sharp about-face … just as we’ve seen every other time in modern history.”

This is still what I believe right now.

In fact, President Trump might be right when he says the first-quarter GDP contraction wasn’t all his doing.

It is at least partly the result of tighter monetary policy that began in March 2022 … accelerated over the following two and a half years …

And, despite a couple of cuts in the fall of last year, it remains far tighter than at any other time in the last two decades.

Meanwhile, the threat of tariffs and associated uncertainty had two big effects …

First, they caused businesses to bring in lots of goods and supplies from overseas as quickly as possible — pushing imports up sharply relative to exports.

That hurts GDP.

At the same time, they probably HELPED the economy toward the end of the first quarter.

After all, consumers rushed to buy things ahead of possible supply chain disruptions and potential price hikes.

All told, consumer spending — which accounts for the lion’s share of GDP in any given quarter — rose 1.8%.

While that was the slowest increase since the middle of 2023, I believe it was substantially higher than it would have been otherwise.

That also means second-quarter GDP — i.e., what’s happening right now — is likely to end up producing far worse numbers.

Now we have consumers who pledge to slow their spending … businesses that remain hesitant to make big decisions … trade, in general, slowing on all sides … and other aspects of the conflict working their way through the global system.

The fact that headlines were recently talking about an economic contraction will only feed into this loop further … particularly on the consumer side.

I’ve talked about self-reinforcing cycles like this plenty of times before — from how they form stock market bubbles to how they stoke inflation.

Whatever way you slice it, I think three months from now we will be hearing an official recession declared.

How long and deep will it be? Much of that depends on how things play out over the next month in terms of trade negotiations.

Suffice it to say, most mainstream economists are still in denial about this.

According to a recent Wall Street Journal survey of them, the average forecast remains reasonable growth for the next four quarters straight.

I will be shocked if that holds true.

And based on current valuations, the stock market will be equally shocked if it doesn’t.

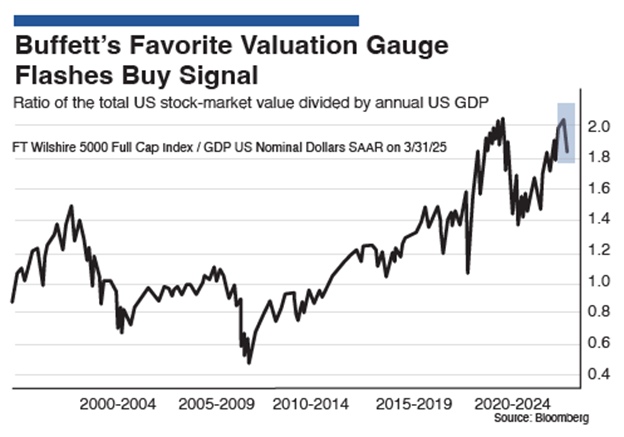

For proof, simply look at this recent headline from Bloomberg …

The indicator they’re talking about is the same one I have discussed with you many times before — the value of all the stocks in the Russell 2000 Index divided by the value of the U.S. economy.

Here’s the chart from the same Bloomberg article …

The assertion was that at 1.8 — i.e., with the stock market valued at 180% of U.S. GDP — now is a good time to buy.

Yet anyone with two eyes can see that, other than two very recent times during this same easy-money fueled bubble, the ratio is still the highest it’s ever been … about 40 percentage points higher than we saw during the Dot-Com Bubble!

That is not a stock market I want to buy aggressively.

That’s why I’ve been focused on helping you protect and grow your wealth outside the stock market.

In fact, I was even part of a special conclave that gives specific ways to do exactly that ahead of what we’re calling “Dollar Devastation Day.”

I hope you were able to attend. If so, you learned several ways to get your money out of U.S. dollars … and still have a chance to earn a tidy profit.

If not, the replay is still available for you to watch.

Just be sure to do that before we take it down in the next few days.

Best wishes,

Nilus Mattive