|

| By Jim Nelson |

With dollar doom, trade wars, actual wars and conflicts in the Middle East and Europe, as well as plenty of other policy uncertainties, many investors have been piling into safe havens.

And there’s one that stands out — and historically, has always stood out: Gold.

Sean Brodrick has repeatedly laid out the case for why gold is so appealing right now … and not just to individual investors.

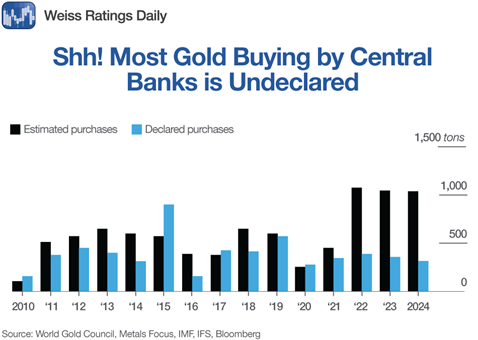

He shared this chart last week showing an enormous amount of gold hoarding by central banks around the world — much of it though unofficial purchases:

There are also plenty of arguments to make that U.S. Treasury bonds are not as appealing as they typically have been in previous periods of uncertainty.

With spiking U.S. debt …

Higher budget deficits on the way due to the Big Beautiful Bill, and …

Foreign investors threatened with new taxes on U.S. investments …

Gold looks like it will shine brighter.

In fact, Sean has repeatedly stated his long-term price target for the yellow metal is $6,900 — more than twice today’s price tag.

But how should you play this continued rally?

You could always buy physical bullion. Nilus Mattive showed you how recently.

Sean has recommended simple ETFs several times.

But if you are up for a little more risk to go with higher potential rewards, you’ll have to look at individual gold stocks.

This is where it can get a bit more complex.

You see, not every gold company is the same.

Today, let’s look at three categories of gold stocks — each with their own advantages and disadvantages.

Gold Producers

This first category is simple.

These are the big gold mining companies that pull the metal out of the ground.

Think Newmont (NEM) and Barrick Gold (B).

Those are the top two gold producers in the world.

And they are leveraged to gold in a way that should make them shine brighter than gold itself as prices continue to move up.

The reason is simple: With every dollar increase in the price of gold, Newmont and Barrick’s profit margin grows without any more effort.

To keep it simple, let’s say it costs $1,500 to extract one ounce of gold and you can sell that ounce for $3,000, that’s already a huge profit of $1,500.

That’s on each ounce!

But let’s say Sean’s price target of $6,900 hits in the next 12 or 18 months.

Then, you’d see a profit of $5,400 per ounce.

Gold only rose a bit more than 100%. Yet miners’ margins grew 260%.

That’s leverage! And that’s why owning gold producers can make you a lot of money in a precious metals rally.

There are other types of gold companies that offer leverage, however.

And these can rise even faster …

Gold Explorers

These are much, much smaller in size than giants like Newmont. But they can pack a bigger punch.

Companies with little to no production don’t fare so well in sideways or down markets for gold.

But when gold rallies, and one of these smaller companies has some proven in-ground resources and reserves, they can skyrocket.

You see, they don’t even have to put shovel to dirt when gold is rallying.

Why? Because their in-ground gold is gaining value even without any costs.

One major reason is because those gold producers above love to add to their own production during such periods by simply buying those resources from the explorers.

Everyone wins. But because explorers are so much smaller, they can grow much faster.

These are not exactly the same as “junior miners.” Many juniors do produce gold themselves.

Those can be a great hybrid of the two types of gold stocks mentioned so far.

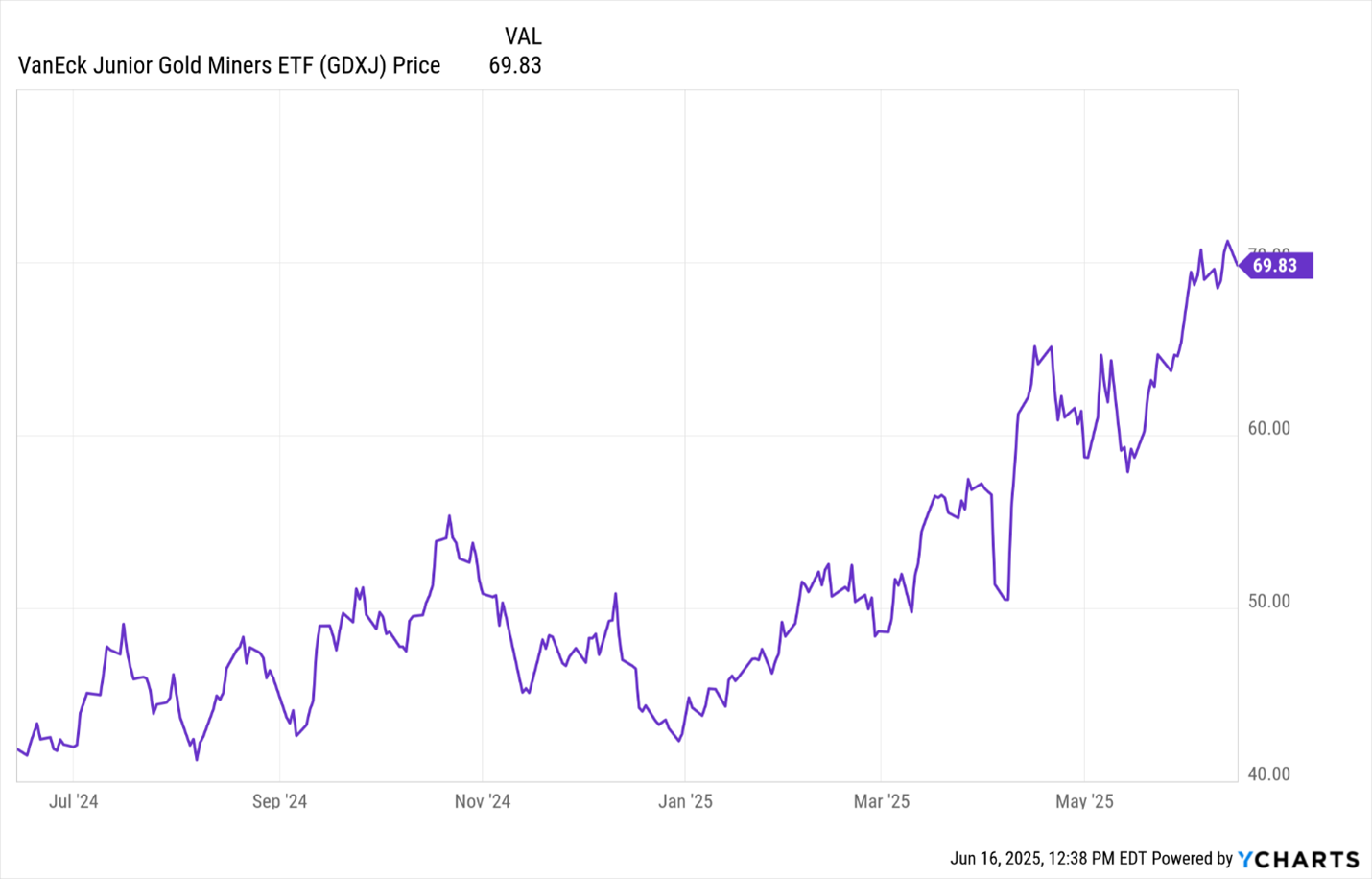

An easy way to play those is through the VanEck Junior Gold Miners ETF (GDXJ). It’s been on a tear the past year:

The last type we should highlight stands apart from them all …

Gold Royalty & Streaming Companies

These companies do not typically explore for new mining opportunities.

They also don’t ever put a shovel in the ground to dig up the metal.

There are basically two types.

Some simply own the rights to gold deposits. And they lease out those rights to miners who do all the dirty work … literally.

Others help finance the setup work of a new mine in exchange for a percentage of the gold production once it is up and running.

Royalty plays offer a very different way to make solid money from gold’s rally.

You see, their costs remain near zero. They don’t have many employees at all.

Yet, for every ounce that is mined at their properties, their revenue — and earnings — grows exponentially.

Streamers are similar but often have their portion of sales set at predetermined prices.

A few examples include Franco-Nevada (FNV), Wheaton Precious Metals (WPM) and Sandstorm Gold (SAND).

Navigating the differences between these three types of gold-leveraged stocks is an art.

Fortunately, Sean is an artist in the field.

And he just put together several reports on exactly which companies are set to boom during gold’s next leg higher.

Watch this exclusive interview for more.

And stay to the end.

He’ll show you how to get the names of each stock that’s best positioned to ride this bull market.

Take care,

Jim Nelson