|

| By Nilus Mattive |

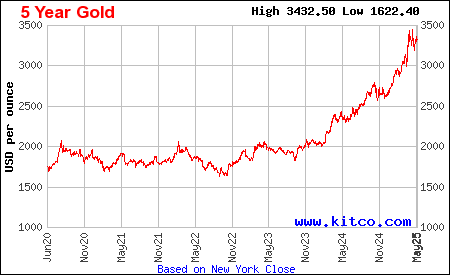

After a few fairly flat years for gold, the metal caught fire in 2023 and 2024. And in the first few months of 2025, it has taken off like a rocket!

Are you too late if you haven’t bought any yet?

Or if you already own some, should you keep adding more?

In my opinion, you definitely want to own physical gold and it makes perfect sense to continue buying now even if you already have some.

Meanwhile, you should also have a position in physical silver.

And you should consider buying stocks and funds leveraged to the underlying metals, too.

My friend and colleague, Sean Brodrick, just put together several important reports to help you do just that.

Of course, HOW you buy gold and silver is critically important. I’ll talk more about that in a minute.

First, I just want to say that I think we will continue to see more gains in gold and other metals investments from here.

Why? It’s pretty simple …

Why Gold Should Continue to Skyrocket

Governments around the world are growing more distrustful of each other …

Citizens around the world are growing more distrustful of their governments …

Debts — both public and private — are soaring to one record after another …

And inflation is still top of mind for many of us.

All that supports higher gold prices.

After all, gold is the original crisis hedge.

It’s the longest-standing antidote to global uncertainty, soaring inflation, government money printing and a whole host of other problems.

And if you have the vast majority of your wealth parked in dollar-denominated assets — or dollars themselves — well, that’s not a very safe strategy.

Just look at the history …

The U.S. dollar has already lost 90% of its purchasing power since 1950.

And that trend will never reverse. We simply have too much debt in the United States.

What’s more, so far in 2025 we have seen the dollar start to weaken against foreign currencies as well.

And President Trump himself has said he would like to see more weakness in the greenback because it makes our exports more attractive to foreign buyers.

So, whether you’re talking about purchasing power domestically or overseas, the dollar looks set to slide further.

Having some of your money in metals and related investments is a simple way to guard against further erosion.

How do you do it?

The Safer Way to Buy Gold and Silver

Importantly, I’m only talking about gold and silver investing.

And by that, I mean investing in strictly liquid, fungible investments — not collectibles.

So, I’m talking about bullion coins, not rare coins, jewelry and other unique assets.

Let me give you the top four brands. Seriously consider …

American Gold Eagle

These were first issued in 1986 by the U.S. Mint and have become one of the most popular gold coins in the world.

They are made strictly with gold mined in the U.S., and their quality is guaranteed by the U.S. government.

Canadian Gold Maple Leaf

The Royal Canadian Mint, founded in 1908, has produced some of the most recognized and valued bullion, circulating and numismatic coins.

The Canadian Gold Maple Leaf coin is 24 karats and up to .9999 fine, pure gold. Since being introduced in 1979, it has also become one of the world’s premier gold bullion coins.

And for silver bullion coins, their counterparts are …

American Silver Eagle

These are the only silver bullion coins actively produced by the U.S. Mint.

They’re struck solely in 1 troy oz denominations and are guaranteed to have 1 troy oz of 99.9% pure silver.

Canadian Silver Maple Leaf

This is considered one of the purest of all silver coins.

First struck in 1988, it contains 1 troy oz of pure silver minted in .9999 fine silver.

Are there also other excellent brands as well?

Absolutely!

For gold coins, I like the South African Krugerrands, the Australian Kangaroos (aka Gold Nuggets) and the Austrian Philharmonic coins.

For silver bullion, other popular coins include Morgan Silver Dollars, Austrian Silver Philharmonics and the British Silver Britannias.

So why am I focusing your attention on the American and Canadian coins?

Mainly because those are the ones our research team tracks most closely, which leads me to …

How to Buy Strictly

from Well-Established Dealers

A reliable dealer should …

- Always be willingly to explain the fees and investment programs they offer.

- Take as much time as needed to better understand your goals and risk profile, explain how to buy gold and make sure you’re aware of any downsides.

- Disclose that gold prices can go either way up or down.

- Sell only high-quality bullion and coins, such as those I mentioned above.

Which are the best dealers?

Here are our picks, based on our own research as well as by other sources:

|

Precious Metals Dealers

|

Prices and markups can change. And some dealers won’t tell you what they charge until you call them.

This list gives a starting point to do your own research by phone or visiting websites.

Best wishes,

Nilus Mattive

P.S. As I noted, you should also invest in stocks and funds leveraged to gold. Why? Because as it continues to boom, these stocks can double or triple the rise in gold prices.

Sean Brodrick has helped readers make a fortune already from the rally so far.

In fact, he called gold’s rise to $3,200 way in advance. His next target is even higher. And he put together this to help you join his readers on their way to wealth.