The Stock at the Heart of America’s Naval Comeback

|

| By Michael A. Robinson |

Since World War II, the U.S. Navy has been the backbone of American power.

But in 2020, that changed.

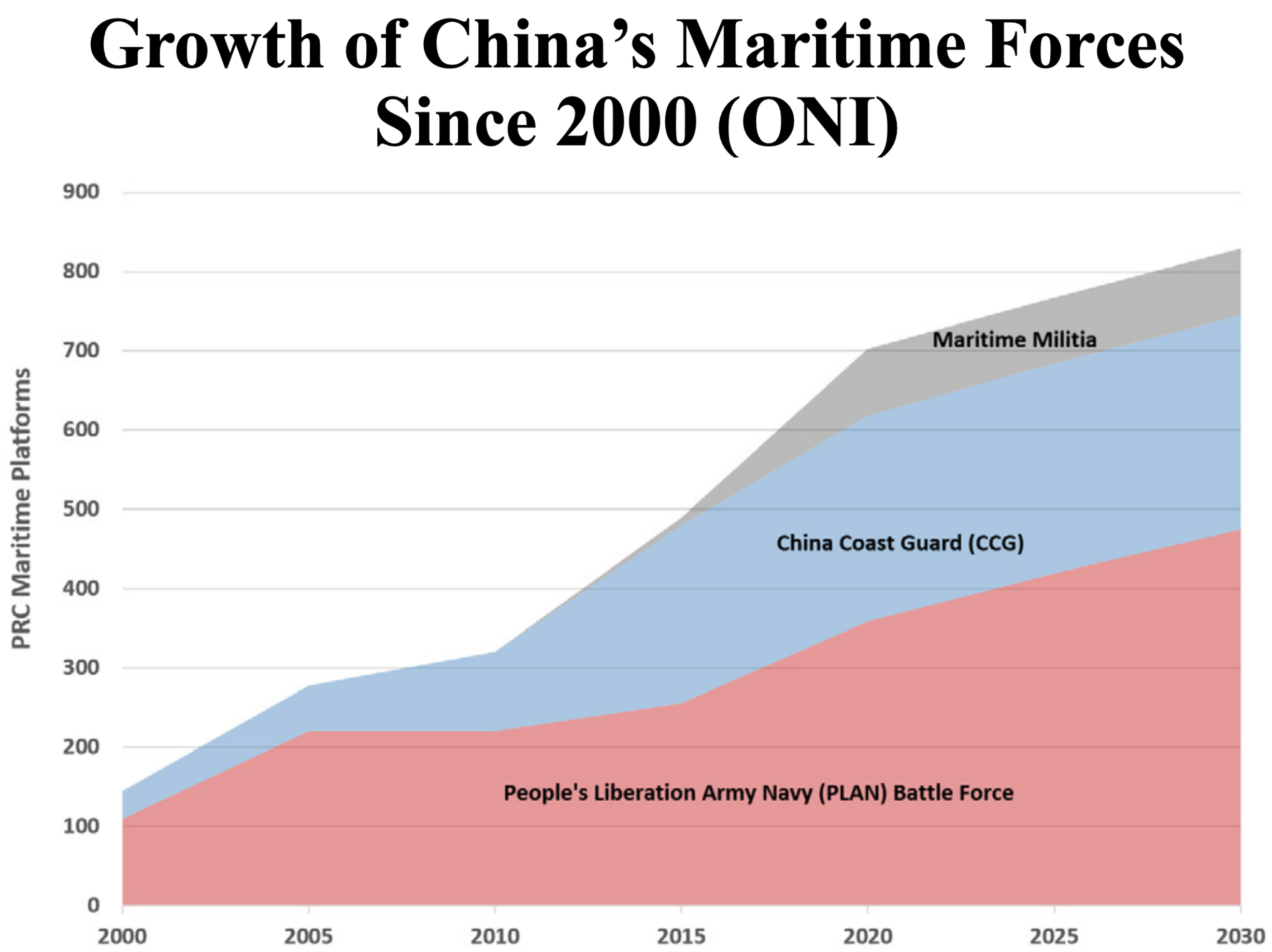

China’s Navy — known as PLAN — surged ahead. Today, it’s 25% larger than ours. By 2030, it’s projected to command the world’s biggest submarine fleet too.

This isn’t about drones or satellites. The nation that rules the seas, rules the world.

Just one example: Great Britain.

Its Royal Navy controlled the oceans for over a century — and dominated global trade, finance and an empire because of it.

President Trump knows what’s at stake.

That’s why he’s pushing for the most aggressive naval expansion since the Cold War.

And I’ve found one company that’s quietly become the Pentagon’s go-to partner for this $257 billion shipbuilding spree.

If you don’t think there’s money to be made in ships, think again.

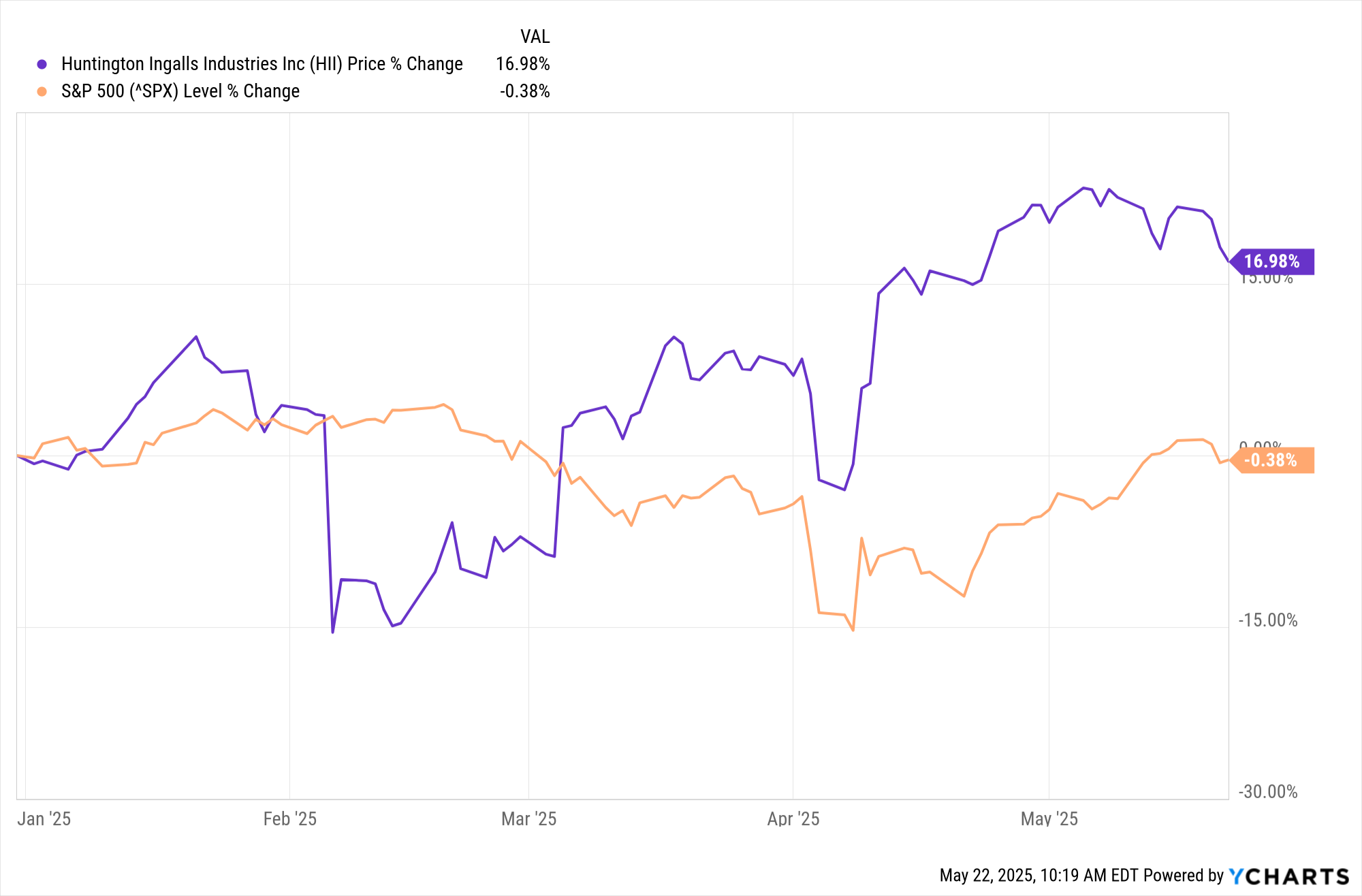

With lots of upside still ahead, the stock of this storied firm so far this year has beaten the broad market by a stunning 1,691% …

A Sea Change — Literally

He may not be a history buff, but President Trump’s laser focus on rebuilding the Navy reflects a hard truth that’s held for thousands of years.

Just consider Rome.

Sure, Hollywood gives us sword fights, gladiators and generals. But it was Rome’s fleet that gave it control of the Mediterranean.

That sea power is what let it supply troops, blockade rivals and dominate trade.

It was the Roman Navy, not the legions alone, that made the empire possible.

Same story in World War II.

America didn’t win that war just because of our fighting forces. We won it by controlling the Atlantic and the Pacific.

It’s what allowed us to land in Normandy, bomb Berlin and — most crucially — counterattack after Pearl Harbor.

No Navy, no island hopping.

No supply chain, no victory in Europe or Japan.

It’s that simple.

And today, with China’s navy now the world’s largest, Washington isn’t just playing defense — it’s preparing for a new kind of war.

One where steel in the water matters as much as AI in the cloud.

That’s why one U.S. company — virtually unknown to most investors — is now at the center of a $257 billion shipbuilding supercycle.

And I believe it’s just getting started.

The One to Watch

The company I’ve found is the largest shipbuilder in the U.S. And every one of its divisions is poised to benefit from this massive naval revival.

Make no mistake. Huntington Ingalls Industries (HII) has deep roots. Those stretch all the way back to 1767.

But its modern structure came together about 15 years ago, when it merged legacy operations into a more diverse powerhouse.

Today, it has three key business segments:

- Surface Shipbuilding — Builds amphibious assault ships, surface combatants, national security cutters and more.

- Nuclear Shipbuilding — Builds and maintains nuclear-powered aircraft carriers and submarines.

- Defense IT & Services — Delivers high-end mission solutions, lifecycle sustainment, autonomous systems and nuclear ops support for both the Department of Defense and Department of Energy.

It even supports global allies.

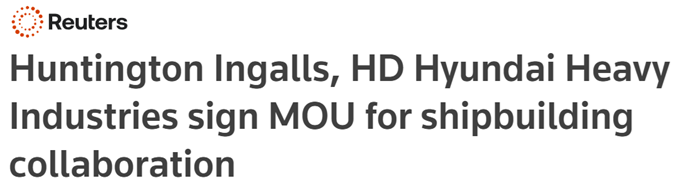

The firm has partnered with South Korea’s HD Hyundai to advance innovation and sidestep tariff risk.

It also trained leadership at five Australian shipbuilders as part of a growing alliance.

And on the sub front — where General Dynamics (GD) typically leads — this company still plays a vital role.

Much of GD’s submarine construction happens at Huntington’s Newport News Naval Shipyard. As submarine budgets expand, so will its share.

It’s even positioned to benefit from the next energy revolution — small modular nuclear reactors (SMRs).

With decades of experience building what amounts to floating nuclear cities, this company is a natural fit to help scale this game-changing tech.

The Quiet War Already Underway

Now then, President Trump recently signed an executive order — one that won’t face legal pushback — for a full review of the Navy and Homeland Security’s ship procurement process.

That’s no paper shuffle.

Rather, it’s a green light for quicker contracts and fast-track upgrades across the fleet.

At the same time, the Secretary of the Navy has launched a sweeping new push for more ships and submarines to match China’s explosive naval buildup.

Some still doubt this signals a new Cold War. After all, the U.S. and China are economically joined at the hip.

But trade strategy and military strategy don’t run on the same track.

China has been expanding aggressively in the South China Sea.

It’s threatening Taiwan, intimidating the Philippines and forging trade deals across the South Pacific.

The U.S. Navy has a presence there. But not enough to maintain dominance.

That’s why America has formed a deeper alliance with the U.K. and Australia — AUKUS — to remind Beijing that China is not the only force in the region.

And Japan and South Korea? They’re watching China’s moves closely — and ramping up naval spending of their own.

This isn’t theoretical.

It’s a slow-moving arms race. And Huntington is already in motion — contracted, capitalized and quietly scaling up.

A World-Class Play

This company doesn’t just build ships. It builds long-term value.

It’s sitting on top of a once-in-a-generation global rearmament trend — one where U.S. allies are boosting naval spending, and the U.S. is driving the largest maritime rebuild since Reagan.

No wonder the stock is on the move.

Wall Street sees the value in having a robust shipbuilder grabbing lots of new defense contracts.

Even after the market’s recent rebound, HII is just plain crushing it.

So far this year, the S&P 500 is completely flat. By contrast, HII has gained a very strong 17%.

By investing in this stock, you will not just be giving support to the nation’s naval buildup … you’ll be making lots of money along the way.

Best,

Michael A. Robinson

P.S. As I said, trade strategy and military strategy don’t run on the same track.

So, while you should consider investing in America’s naval buildout, you’ll also want to add wealth protection away from our shores.

That’s why my colleague, Nilus Mattive, and his Shadow Wealth Council put together this important “wealth conclave” presentation. I urge you to watch it while you still can.