|

| By Jim Nelson |

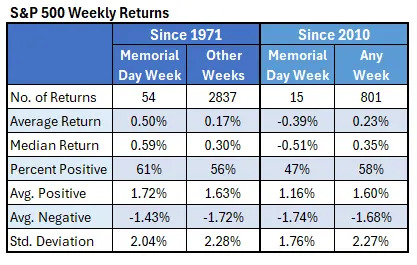

Historically, the week following Memorial Day has been a great time to invest.

From 1971 — when the holiday was fixed to the last Monday of May — until now, this week produced an average gain of 0.5% for the S&P 500.

For perspective, the overall average weekly gain for the index since then has been 0.17%.

So, it’s generally been a good time to add positions. Or at least it was until 2010 …

Data compiled by Yahoo Finance shows that a big change occurred just after the Great Recession.

After nearly four decades of being one of the best times to invest, Memorial Day Week turned into a terrible one to buy.

The S&P 500 has averaged -0.39% since 2010 during this week.

Of course, there’s a lot more going on right now than most of those other years:

- The Big Beautiful Bill is still going through Congressional approval.

- New potential tariffs are being considered on Apple (AAPL) specifically and Europe in general.

- Moody’s just downgraded U.S. debt following previous downgrades from S&P and Fitch.

So, we’ll have to see what else transpires over this extended weekend before placing any bets on next week’s action.

Fortunately, your experts are able to make accurate forecasts for periods beyond just one week.

Here’s what they are recommending you do …

The Stock at the Heart of America’s Naval Comeback

One thing the Big Beautiful Bill includes — and likely every future version of it will as well — is increased spending on the U.S. Navy. Michael A. Robinson has the way to play it.

This Major Rally Just Got Another Catalyst

While stocks hesitated this week after a sizeable comeback, another asset showed no fear — Bitcoin. Juan Villaverde says there’s another catalyst that could send it to $150k soon.

America Is in a Death Spiral of Debt

Even before the BBB passed the House, Sean Brodrick already pointed out the problem with U.S. debt … and the perfect way to profit from it.

If the U.S. debt situation and the upcoming Memorial Week Reversal weren’t enough to keep you away from stocks this week, Nilus Mattive lays out another red flag for U.S. equities.

And if you thought of simply packing your bags and leaving the country would help, think again. Nilus also explains a problem even the new pope can’t escape.

There is something you can do about all of this, however. You can watch the “Emergency Wealth Conclave” before it is taken down from our site. I recommend you do so today.

That’s it for this week. Have a great holiday weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily