|

| By Sean Brodrick |

America is in a financial pickle. Our gherkins are getting squeezed, and the outlook is worse by the week.

The bond market knows it. Which is why the 30-year bond yield is soaring toward levels last seen in the Great Financial Crisis.

The gold market knows it. That’s why the yellow metal has put on its running shoes.

Yet, Wall Street is ignoring it … for now. The question is, how long can the party last?

The crisis I’m talking about is America’s debt …

The U.S. federal budget deficit surged to $1.8 trillion in 2024. Deficit spending is projected to reach $1.9 trillion in 2025.

This is without any war going on or any other major crisis.

In other words, our normal state of affairs ends with America $1.9 trillion deeper in the hole.

Along with taking on new debt, we must refinance the old debt.

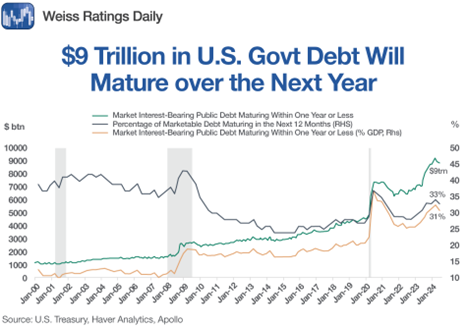

America has approximately $9.2 trillion in Treasury debt maturing in 2025. That’s about one-third of all outstanding marketable debt.

Who the heck is supposed to buy all that?

To refinance the maturing debt, the Treasury must issue a substantial amount of new securities.

But buyers — including institutions, funds and central banks around the world — can see how Uncle Sam writes checks his butt can’t cash.

They hesitate to buy anything but the most short-term bonds, which sends longer-term bond yields soaring.

The 30-year Treasury yield is now approaching a level seen 19 months ago, when inflation was red-hot.

Inflation has cooled down, but America’s spendthrift ways haven’t chilled.

The peak before that was in 2007 … in the depths of the Great Financial Crisis.

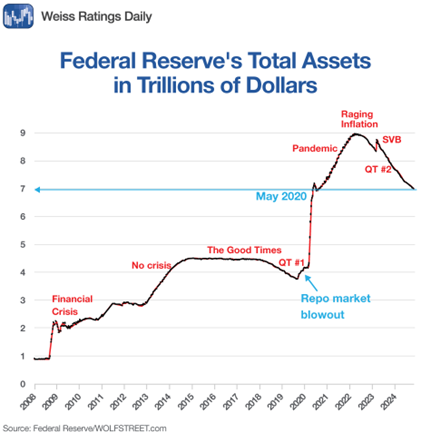

If buyers are scarce, the buyer of last resort is the Federal Reserve itself.

The problem is that the Fed has been the buyer of last resort since the pandemic, sending its balance sheet soaring.

The Fed recently lowered its balance sheet, but that unwinding is part of why bond yields are so high.

Yeah, It Can Get Worse!

Are you ready for the bad news? Treasury yields can go a lot higher.

Now, that’s good for savers. But not for spenders … like the government.

America could be sliding into a debt death spiral.

That’s because Congress is moving closer to passing President Trump’s budget bill.

You’ll hear it finances tax cuts for billionaires by cutting Medicare access for 13.7 million people. That’s true, and it isn’t good.

What’s worse is it blows out the budget deficit like a hippo huffing a paper bag.

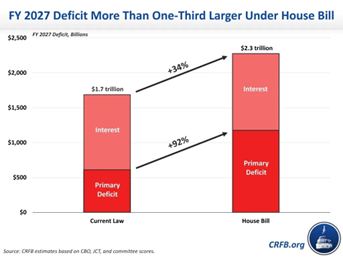

How bad? The Committee for a Responsible Federal Budget's (CRFB) analysis of the House's reconciliation budget bill shows it would increase the fiscal year 2027 deficit by nearly $600 billion.

That means boosting the total deficit by a third from $1.7 to $2.3 trillion. It also means nearly doubling the annual non-interest deficit.

You can read the CRFB debt analysis here.

This is why Moody's recently downgraded the U.S. credit rating from “Aaa” to “Aa1.”

America’s government isn’t doing anything to fix its out-of-control deficit. It’s making it worse!

Potential bond buyers look at this and realize that our government is not run by serious people — not serious about controlling the debt, anyway.

Follow China’s Lead

So, what do they do? They do what China is doing.

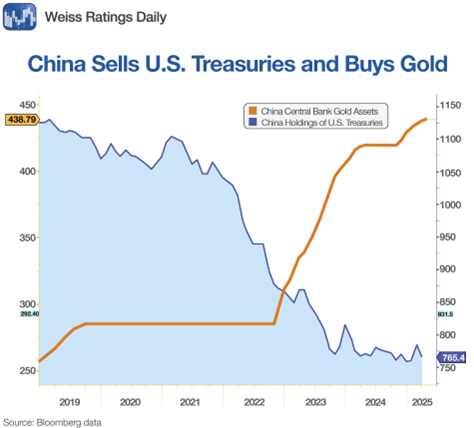

And that is, sell U.S. Treasury bonds and use the money to buy gold.

Here’s a chart of official Chinese gold holdings and official Chinese holdings of U.S. Treasury bonds …

It’s not just China. Central banks around the world have bought more than 1,000 metric tonnes of gold in each of the past three years.

In Q1 of this year, they collectively added 244 metric tons to their reserves, which is 24% above the five-year quarterly average.

As more central banks, more foreign investors and more large institutions shift out of Treasury bonds and into gold, America will edge closer and closer to the vortex of a debt doom spiral.

And once you get into that, it’s very tough to get out without a reevaluation and massive pain.

Making matters worse, as other countries dump U.S. Treasury bonds, yields will rise, which will trigger inflation, too, because the Treasury will have to print more money.

It doesn’t have to be this way. A simple 1% wealth tax on the top 10% of Americans would fix the budget problem indefinitely. But billionaires own the U.S. government lock, stock, and smoking barrel. That fix is never going to happen.

So, what should you do? I think you should act like the Chinese … and the Japanese … and the Poles … and most central banks around the world. Buy gold.

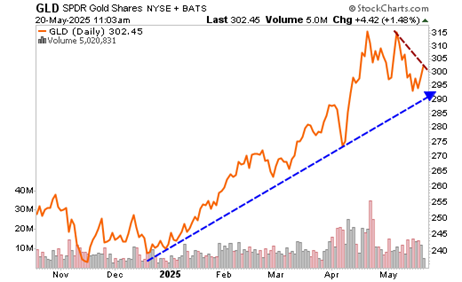

Heck, I recommended the SPDR Gold Shares (GLD) in Weiss Ratings Daily on Jan. 8 of this year.

This ETF holds physical gold and tracks the price closely. If you’d bought GLD then, you’d already be up 24%.

Here’s a chart of GLD …

You can see gold’s latest sprint started late last year. Now, it is consolidating its gains, but probably not for much longer. The big uptrend remains intact.

Don’t think about what you’ve missed. Think about the potential upside if you are long gold — and how gold can protect the rest of your portfolio, as America edges toward its debt death spiral.

There are many other things you can do to protect yourself and your wealth.

In fact, just yesterday, several wealth experts just held an Emergency Wealth Conclave to discuss how to avoid the worst of this.

You can still view this event before it is taken down. The clock is ticking. I urge you to take the first steps now.

All the best,

Sean