|

| By Marija Matic |

Something extraordinary is unfolding in the crypto markets.

While retail investors were distracted or sidelined, Bitcoin (BTC, “A-”) quietly doubled over the past year — leaving the S&P 500’s 11% gain far behind.

Hitting a staggering $122,000 per coin earlier today, Bitcoin is powering what may become the largest wealth transfer in modern financial history.

The Smart Money Moves Fast

The numbers speak volumes.

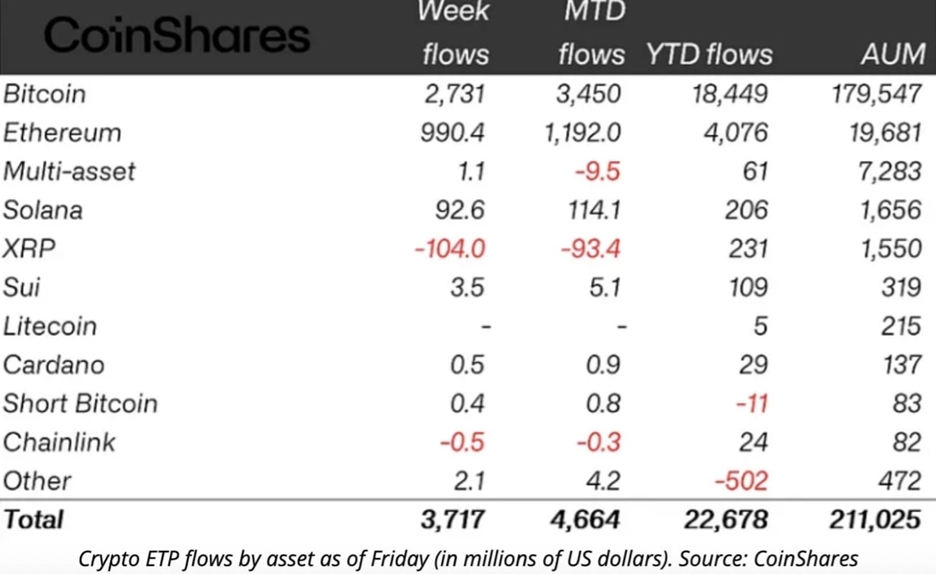

Digital asset investment products just logged their second-largest weekly inflow ever — $3.7 billion.

This pushed total assets under management to a record $211 billion.

But here’s the kicker: long-term holders — the so-called “smart money” investors who’ve held through crashes and rallies — now control over 74% of Bitcoin’s total supply.

That’s the highest concentration in 15 years.

And it isn’t just accumulation. It’s strategic hoarding.

To put it plainly, the big players aren’t trading. They’re locking in.

Washington's Crypto Reset

Behind the scenes, the regulatory revolution continues to press ahead.

Congress is preparing to vote on three transformative bills that could establish the U.S. as the world’s dominant crypto hub. They are …

- The GENIUS Act, which has already sailed through the Senate. This gives private firms legal authority to issue stablecoins. Now, it is waiting a vote in the House.

- The Clarity Act seeks to end the long-running turf war between the SEC and CFTC. This will finally give the industry regulatory certainty.

- The Anti-CBDC Surveillance State Act aims to block government-issued digital currencies and protect decentralized crypto.

This isn’t minor legislative tinkering. These bills represent a paradigm shift.

With regulatory fog lifting, corporations that once stood on the sidelines can enter the arena with conviction.

The Corporate Gold Rush Is On

Bitcoin isn't the only digital asset making corporate headlines.

Ethereum (ETH, “A-”) has increasingly become the asset of choice for forward-thinking institutions. Especially as ETH ETF approvals with staking now appearing imminent.

BitMine Immersion just went nuclear on ETH, stacking 163,000 coins worth half a billion dollars after raising $250 million.

Not to be outdone, SharpLink Gaming bought 10,000 ETH directly from the Ethereum Foundation itself. Its total holdings now stand above 222,000 ETH.

When you see a trend of corporations making moves like these, you should look for the writing on the wall.

Because these aren't speculative bets. Companies like these don’t play with funds like that.

Related story: 3 Ways to Play a $225 Million Ethereum Bet

What we’re seeing is the "MicroStrategy playbook" spread beyond Bitcoin.

And Ethereum is becoming the treasury asset of choice for forward-thinking corporations that want to position themselves for both capital appreciation and potential staking yield.

The Unlikely Crypto Stars

While Bitcoin and Ethereum grab headlines, two surprising tokens are stealing the show:

Stellar (XLM, “B”) soared 85% after PayPal announced its PYUSD stablecoin would launch on the network.

But this goes beyond a regular partnership. Stellar’s edge lies in its built-in “Anchor system,” where regulated banks serve as compliant bridges between crypto and traditional finance.

Compliance isn’t an afterthought here. It’s native.

And that will make a big difference when courting corporate users.

Our other surprise asset is Pudgy Penguins (PENGU, “E+”), which jumped 92%.

My colleague Jurica Dujmovic has explained this playful NFT brand — and its impressive resilience — before.

Now, plush toys based on this collection sit on shelves in Walmart and Target. Each one includes a unique code that unlocks Pudgy World — an online game where users can personalize their penguin and explore a digital adventure.

With PENGU tokens planned for in-game use, it’s a full-circle web3 experience that bridges physical products, gaming and crypto.

The Dragon Stirs

Perhaps the most intriguing development is happening 7,000 miles away in Shanghai.

China's State-owned Assets Supervision and Administration Commission — the same government body that once championed the crypto ban — is now "exploring policy responses" to cryptocurrencies.

Director He Qing has called for “deeper research” into stablecoins and blockchain infrastructure. This move could potentially pave the way for a yuan-pegged stablecoin.

To be clear, China’s crypto trading ban still holds. But Shanghai has a history of soft-launching reforms before Beijing makes sweeping decisions.

Which is why I’ll be watching this situation closely.

Related story: Hong Kong May Have Just Sparked a Stablecoin Shift

If China pivots, it could ignite the next global crypto narrative and a seismic shift in global adoption.

A New Financial Order

If you’ve sat through the tepid market we’ve faced for most of the year, this relief rally is very welcome.

But don’t lose the forest for the trees. Because this isn’t your standard hype-driven bull run.

It’s the beginning of a new financial architecture.

The age of retail-driven FOMO is fading.

In its place, we’ll see pension funds, public companies and governments reshape their strategies to include digital assets.

The moment is surreal.

U.S. lawmakers are clearing regulatory minefields ...

Corporations are loading up ...

Even crypto-skeptic China is re-evaluating its stance!

Meanwhile, Bitcoin’s supply is increasingly locked up by true believers.

Which means these winds of change are swirling to create a perfect storm: Institutional demand is set to collide with vanishing supply.

For those already in the crypto space who are paying attention, we’re not just watching history unfold.

We’re participating in the opening act of crypto’s ascent from fringe experiment to foundational pillar of global finance.

The revolution isn't coming.

It's already here.

I hope you’re ready for it.

Best,

Marija Matić