Bitcoin Claims New All-Time High to Extend Bull Market

|

| By Juan Villaverde |

On May 21, Bitcoin (BTC, “A”) shot past its previous all-time high, established in January 2025.

And yesterday, it reached a peak of $111,814.

I said this would happen. I saw the signs my Crypto Timing Model was flashing for the past month.

And I saw how the macroeconomic situation — including rising global liquidity and the latest pause in the Sino-American trade war — added rocket fuel.

What I’m seeing now, though, is huge.

While my model — and crypto’s cycle history — suggest that crypto’s four-year cycle peak may be due in a few months …

I don’t believe the bull market won’t end there.

On the contrary, it seems set up to heat up even more.

Allow me to explain …

Central Banks’ Problem Is Bitcoin’s Promise

There’s an old saying: Owing the bank a little money is your problem.

But if you owe a lot, suddenly it’s the bank’s problem.

That’s exactly where the world finds itself today with America’s debt.

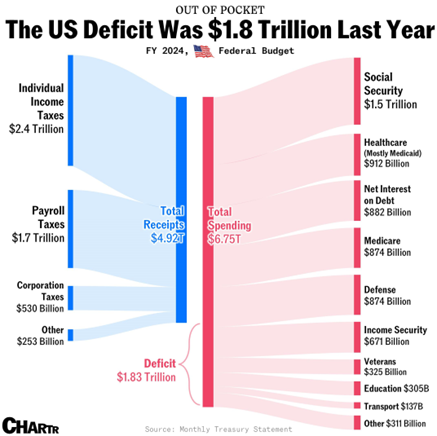

At $1.83 trillion — about 6.4% of GDP — the 2024 federal deficit was the third largest on record, excluding the pandemic year.

Was there some emergency to justify this spending? Nope.

For decades, the U.S. government has enjoyed and abused the “exorbitant privilege” of issuing the world’s reserve currency. The resulting global demand for dollars translates into strong demand for dollar-denominated assets. Like Treasury notes and bonds.

Yet even that demand may not be enough to absorb the torrent of new Treasury issues, which stand at 9 trillion dollars’ worth this year alone.

The most worrying part? Roughly 50% of the $1.8 trillion deficit is just interest on earlier borrowing.

On top of that, this percentage is set to keep going up as the Federal Reserve keeps rates “higher for longer.”

In truth, this slow-motion borrowing binge has been underway for decades.

- In 2011, S&P became the first major ratings agency to cut U.S. debt from AAA to AA+.

- Fitch followed in 2023. And last week …

- Moody’s lowered its rating from “Aaa” to “Aa1,” citing the same issues: fiscal profligacy, rising debt and sky-high interest costs.

The market reaction? Barely a ripple.

Yields ticked higher after the downgrade, but they had already been creeping up.

Historically, a weaker dollar boosts foreign demand for Treasury bonds. But not this time. Lately, massive supply seems to be overwhelming demand.

With $36 trillion outstanding, the Treasury market is the backbone of the global financial system. Dollars in your bank account are effectively backed by Treasury bills, notes and bonds.

Foreign-exchange reserves around the world are, in large part, U.S. Treasury bonds. And because of this, nobody wants a U.S. default — a fact that gives Washington enormous leverage.

The big immediate problem, however, is the Fed’s “higher-for-longer” policy.

Since 2008, the Fed has stepped in whenever private buyers balked at the oversupply of U.S. government bonds on offer. But the 2022 rate-hiking campaign really blew a hole in the budget.

More than half of the nearly $2 trillion deficit is now interest. The math is brutal: high rates → bigger interest bill → bigger deficit → even higher interest bills.

To get some measure of relief, either rates or spending must fall. However, the latter seems most unlikely.

Especially, with a new Trump administration poised to push historic tax cuts. Indeed, the chances of Washington trimming its spending habits are probably worse than the proverbial snowball in hell.

That means interest rates will have to come down. And the Fed will again have to foot the bill with some form of money-printing.

Fed Chair Jerome Powell is determined not to repeat the 2021—’22 inflation surge. So, he talks tough, citing proposed tariffs as another reason to stay restrictive.

But the deficit pays no attention. It just keeps setting records.

This stand-off matters. If Powell won’t cut, his successor (due early next year) almost certainly will.

When that happens, the floodgates will open, unleashing liquidity that could catapult crypto to uncharted heights.

What this amounts to is a compelling vision of a long-term crypto bull market:

- A profligate U.S. Treasury continues spending money like a drunken sailor on shore leave.

- The Fed monetizes the damage to prevent a U.S. Government default.

- Bitcoin (and other crypto assets) soar into the stratosphere.

Crypto’s four-year cycle peak may be due in a few months.

But the bull market won’t wind down in 2025. It’s set to keep running — until governments stop printing money to paper over their mistakes.

And I sure wouldn’t hold my breath, waiting for that.

Today, Bitcoin has pulled off its recent highs. Savvy investors should see this pullback as a buying opportunity.

Because BTC has much farther to go before this situation resolves.

Best,

Juan Villaverde

P.S. Bitcoin’s bullish outlook stands in stark contrast to the TradFi market at the moment. My colleague and editor of Safe Money Report, Nilus Mattive, recently explained in his opinion Why Stocks Are Doomed.

It’s no wonder we’re seeing an exodus into gold and Bitcoin — two safe haven assets investors flock to when stocks suffer. But they’re not the only ones you should consider if you want to protect and grow your wealth outside the stock market.

To learn about other off-the-grid opportunities and how they can help you navigate this delicate market, I urge you to watch our Emergency Wealth Conclave now.