A month ago, I published an article asking: “Is It Time to Buy Oil?” In it, I laid out the bullish case for crude and especially oil-leveraged stocks.

And, as it turns out, that was exactly the right view. Oil stocks have gushed higher since.

So, what’s happened? This past month has seen international and U.S. oil benchmarks break out of ranges that held them trapped since June. Now, they’re hitting the highest prices since March. The U.S. crude oil benchmark, West Texas Intermediate, recently pushed over $47 a barrel.

A lot of oil companies — who cut fat to the bone as the pandemic slammed home — can make tidy profits at $47 a barrel.

Why is this happening? I can see three main drivers.

1. Hopes for a Vaccine. With multiple COVID-19 vaccines working their way through the system, traders see light at the end of the pandemic tunnel. They expect energy demand to return to normal in 2021 and are buying oil and gas ahead of that.

Heck, Great Britain is already vaccinating vulnerable people and essential personnel. The first person in that country received the Pfizer Inc. (NYSE: PFE) vaccine on Tuesday. In America, vaccines may not be widely available until mid-2021, the but the market is driven by anticipation.

2. Stimulus Surge. Not just here, but around the world, governments are readying more stimulus to shake their economies out of pandemic-induced slumps.

Japan just announced $708 billion in new stimulus spending. The European Central Bank boosted its existing COVID-19 stimulus spending by $606 billion, to $2.18 trillion. That’s on top of a $908 billion recovery fund the ECB is also working on. Here in the U.S., Washington is trying to argue out a stimulus package in the $900 billion range.

And when it comes to oil, China’s crude oil imports hit 45.36 million metric tons in November. That’s equal to 11.04 million barrels per day (bpd), up from 10.02 million bpd in October.

3. Bad News Is Good News. One of the best indicators of a bull market is when something goes up on bad news. Well, the oil markets got some “bad news” this week as members of the Organization of Petroleum Exporting Countries and affiliated nations, including Russia, agreed to add 500,000 barrels of production to markets in January.

Market’s reaction: Prices went up. Hm.

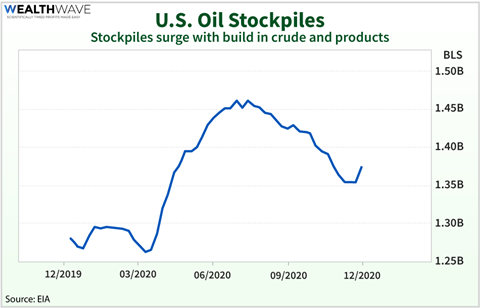

And there was more bad news. On Wednesday, the Energy Information Administration reported a massive crude oil inventory build of 15.189 million barrels for the week to Dec. 4. This is close to the largest build in U.S. crude stocks — ever!

Sure, inventories are way off their highs earlier this year … but that’s still a huge one-week jump. The market’s reaction? You guessed it … prices went up.

When prices go higher in the face of “bad news,” that’s a bull market.

So, that’s my one-two-three of why oil prices are going higher. They could go lower, if bad news starts being bad news again. In the meantime, oil prices are breaking out and oil-leveraged stocks are going along for the ride.

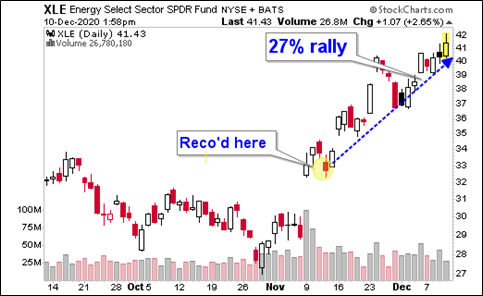

A month ago, when I last talked about oil, I recommended the Energy Select Sector SPDR Fund (NYSE: XLE). It’s stuffed with Chevron Corp. (NYSE: CVX), ExxonMobil Corp. (NYSE: XOM), Phillips 66 (NYSE: PSX) and other big names. It is very liquid and has an expense ratio of 0.13%.

Let’s see how the XLE has done since then.

You can see that XLE has climbed 27% since I talked about it last month. Here’s the thing: The fat lady ain’t singing yet. My price target on the XLE is $66 a share.

Things could change. I’ll keep my subscribers posted. My Gold & Silver Trader subscribers are playing this rally for all it’s worth. If you’re doing this on your own, be careful, do your research and, by heck, put some money to work!

All the best,

Sean