Growth Vs. Value: The Biggest Choice Facing Investors Today

With the market roaring ahead, many investors are piling into growth stocks. I don’t blame them. After all, if they think that the trade agreement between the U.S. and China — which is still in the works — will open the door to growth, then it’s full steam ahead.

But that’s only one view. Another is that the market is due for a correction, and value stocks will come into play.

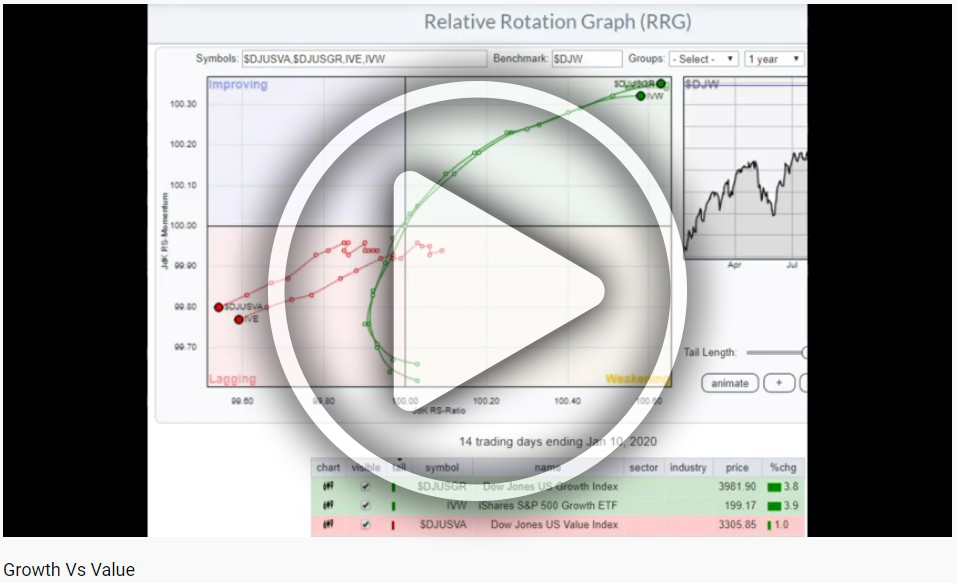

I explain what stocks are doing well, and what stocks might do even better if value starts to come back in fashion in this new video:

Click here to view the relative rotation graph I talk about at 0:26 in the video.

If you like growth stocks, an easy way to play it is the iShares Core S&P U.S. Growth ETF (Nasdaq: IUSG). It has an expense ratio of just 0.05%. And a dividend yield of 1.33%. That’s a pretty darned good dividend yield for a growth fund. This fund closely tracks the Dow Jones growth index I mention in the video.

If you like value stocks, consider buying Vanguard Value Index Fund ETF Shares (NYSE: VTV). It has an expense ratio of just 0.08%, and a dividend yield of 2.37%. This fund holds many of the same stocks in the Dow Jones value index I mention in the video.

Have a great weekend,

Sean Brodrick