Last week, I talked about hypersonic missiles.

This week, I want to talk about vehicles that are somewhat slower ...

Because as we all know, the vast majority of vehicles travels at subsonic speeds ...

From fighter jets (most of the time) ... all the way down to lawn mowers and golf carts.

There’s one company in particular that serves the whole range of subsonic vehicles better than almost any other: Textron (NYSE: TXT).

Textron started with humble beginnings as a textile company in 1923 when 27-year-old Royal Little founded the Special Yarns Corporation to produce synthetic yarns.

By the start of World War II, the company was known as Atlantic Rayon Corporation, making parachutes ...

... and hinting at its future position at the forefront of the aviation industry.

As the war wound down, the company began making civilian products and was renamed Textron: “Tex” for “textiles” and “tron” from synthetics like “Lustron.”

- The company was listed on the New York Stock Exchange (NYSE) in 1947.

Little began turning Textron into a conglomerate in 1953, when he bought Burkart Manufacturing Company (upholstery filling for the vehicle seats), followed by the acquisition of Dalmo-Victor (airborne radar antennae) in 1954.

In 1960, the company continued its innovative pursuits and bought Bell Aerospace — maker of Bell Helicopters — and E-Z-GO —electric and internal combustion engine (ICE) golf carts and utility vehicles — under the E-Z-GO, Cushman and Bad Boy Buggy brands.

Textron purchased Jacobsen Manufacturing around 1975 and continues to sell maintenance vehicles (i.e., very big lawn mowers) for golf courses, sports venues and commercial properties.

And even more recently, in 2017, the company acquired Arctic Cat, a maker of snowmobiles and all-terrain vehicles (ATVs).

- But it’s the Textron Aviation segment — formed in 2014 from Beechcraft and Cessna — that dominates sales, handing the company 34% of its revenues in 2020 (Bell Helicopters comes in second at 28%).

That includes $3.97 billion in aircraft and parts and services.

With a range that includes everything from business jets, turboprops and high-performance pistons, to special mission, military trainers and other defense products, Textron Aviation has the most comprehensive portfolio for aviators of all stripes ... and a workforce that’s produced over half of all general aviation aircraft globally.

A related segment is Textron Systems, which makes unmanned aircraft (i.e., drones) and surface vehicles ... flight simulators ... airborne and ground-based surveillance systems ... precision-guided weapons ... marine craft ... armored vehicles ... piston aircraft engines and more.

- Headquartered in Providence, Rhode Island, Textron employed over 37,000 people worldwide in 2018.

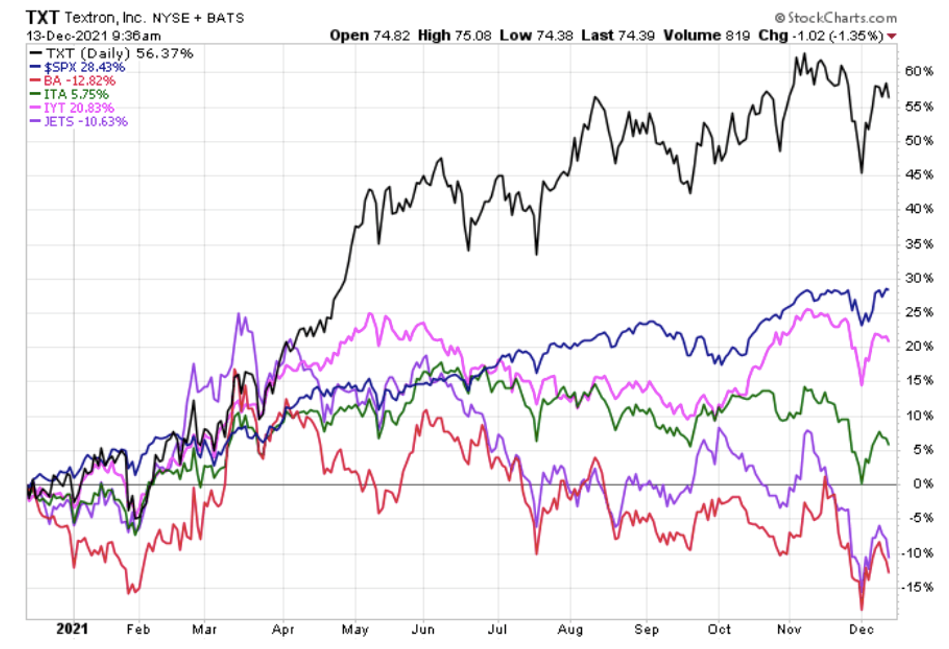

And look how the company has smoked it over the past year, outperforming the S&P as a whole; airlines as tracked by U.S. Global Jets ETF (NYSE: JETS); aerospace and defense as tracked by iShares US Aerospace & Defense ETF (BATS: ITA); the transportation sector as tracked by the iShares U.S. Transportation ETF (BATS: IYT) and even major aircraft manufacturers like Boeing (NYSE: BA) ...

Some would say this is a “boring” stock ... but it’s up a whopping 56% since Jan. 1.

I’ll take that any day!

Sometimes, the non-flashy picks are the really big winners, and my Wealth Megatrends subscribers can attest to that — they’ve recently closed out recommended trades of 168% and 77% on names that probably wouldn’t be the first to come to mind.

If you’d like more info for Wealth Megatrends, click here now.

All the best,

Sean