Last week, we saw how electric vehicles (EVs) are putting upward pressure on base metals, especially nickel. Indeed, demand from EVs and renewable energy are putting relentless upward pressure on copper demand.

For example, if renewable-related copper demand doubles in the next 10 years — which seems likely — that would add 800,000 metric tons to global demand, or 3.3% of the current demand for refined copper (which is 24.4 million metric tons). That’s 61% as much as all the copper the U.S. produced last year, and the U.S. is the fourth-biggest producer in the world.

So, that’s bullish. But that’s not the really bullish thing about copper.

No, the really bullish thing is the world’s growing middle class.

A whopping 51% of copper consumption worldwide comes from construction and infrastructure. And as the middle class grows, there will be more need for those and other things that make middle class living, not just in the U.S., but overseas as well.

The Indian economy, for instance, is expected to be 30 times larger by 2050.

And then there’s CHINA.

The Middle Kingdom’s copper import boom rolls on.

China makes up 51% of global copper consumption. And that demand is 10 times greater than ALL the renewable and EV-related demand worldwide.

Imports of unwrought copper were a whopping 618,000 tons in October, bringing the year-to-date total to 5.6 million tons, already a record annual high with a month to spare.

This looks like a rerun of the financial crisis ten years ago.

Then, as now, China sucked up the world’s copper surplus on a combination of low prices, stimulus-induced economic recovery and a wave of building, both commercial and strategic.

And its transition to a service economy is lifting demand even more.

Low prices early in 2020, when London Metal Exchange (LME) copper sank to $4,371 a ton, were even more enticing for the world’s largest buyer, especially with the appreciating yuan currency.

China bought 1.17 million tons more refined copper this year than last. It’s a mega-spree.

Plus, demand from a recovering Chinese manufacturing sector comes at the same time as a raw materials shortfall.

Throw in rumors of state stockpiling … and you have a perfect storm driving these exceptionally strong imports and skyrocketing prices.

Copper will always be a cyclical industry which means the only thing you can count on is volatility. The best investment for copper — as with any other market — is to buy low and sell high.

But with the long-term outlook being so positive, even short-term pullbacks are buying opportunities …

Here are three particularly attractive ways to play this trend …

1. United States Copper Index Fund, LP (NYSE: CPER) is designed to reflect the performance of the investment returns from a portfolio of copper futures contracts on the COMEX exchange. It’s up over 22% in 2020 and a whopping 67% since its March low.

2. Global X Copper Miners ETF (NYSE: COPX) tracks the price and yield, before fees and expenses, of the Solactive Global Copper Miners Total Return Index. The fund invests at least 80% of its total assets in the securities, American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) of the underlying index, which is designed to measure market performance of companies involved in the copper mining industry. It’s up over 32% in 2020 and a staggering 180% since its March low.

3. Freeport-McMoRan Inc. (NYSE: FCX), one of the world’s largest copper miners, extracts copper, gold, molybdenum, silver and other metals in North America, South America, and Indonesia.

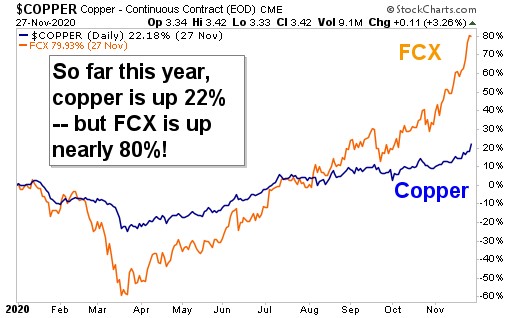

As of Dec. 31, 2019, its estimated consolidated recoverable proven and probable mineral reserves totaled 116 billion pounds of copper. It’s up nearly 80% in 2020, and a mind-blowing 377% since its March lows. And as this chart shows, it is leaving copper in the dust.

This is happening because the miner is leveraged to the underlying metal.

As good as this is, I believe there are even better bargains in copper miners. Heck, I just recommended one to my Wealth Megatrends subscribers yesterday.

Middle class demand for copper is the key long-term driver. Plus, as the world’s middle class grows from 3.5 billion to 5.5 billion souls by 2030, even if they buy only one item of “white goods” (large appliances) — that is 2 million tons added to copper demand.

And if they also buy electric cars, even better.

All the best,

Sean

P.S. China’s rise threatens to engulf more than just the world’s copper supply. We’ll be looking more at the Middle Kingdom over the coming weeks, so stay tuned!