Bearded Spock ... Year of the Bear ... Copper Pain ... Recession Indicator

I think “Bearded Spock” is my spirit animal. Let me explain: In an episode of the classic TV series “Star Trek,” the crew journeyed to a “mirror universe.” Everything was the opposite of their world. And Spock had a beard.

Well, on Thursday, I saw the Dow fall by about 2.8%. The Supercycle Investor portfolio was up about 2.8% at the same time.

How are we doing it? Gold miners. Dividend-payers. Inverse funds. The investments for a Bear Market.

They’re doing quite well for us. And if I’m right — and we’re headed into the King Grizzlies of markets — they’ll do a lot better.

If you’re of the same mind that we are headed into the teeth of a bear market, I have two must-see charts for you today. But first …

China’s Year of the Bear

2019 is the Year of the Pig, according to the Chinese zodiac. I think they need to swap that out. Call it the Year of the Bear. Because something ugly is waking up out of hibernation in China.

The Chinese economy is slowing after decades of breakneck expansion. Growth in 2018 is set to be the weakest since 1990. And 2019 looks even worse.

It’s so bad, China just boosted a big, big infrastructure project. It’s planning to build 4,225 miles of new high-speed railways in 2019. That’s a 40% jump from last year. ALSO, the government just trotted out a new plan to cut reserve requirements at banks. This should inject about $116 billion into the economy. It also raises the risks if things go wrong.

Meanwhile, more than one in five apartments in Chinese cities — roughly 65 million — are empty. And China’s annual auto sales fell for the first time in two decades. I guess that trade war is biting, eh?

But why should anything go wrong? Keep smiling, comrade!

Now for the charts …

Copper Has an Rx for Pain

They call it “Doctor Copper” because it has a degree in economics. When the global economy cools off, copper goes lower. When the global economy heats up, copper goes higher. Now, copper seems to be tumbling toward the cellar.

Source: Bloomberg

The red line is copper’s 2018 low, which copper tumbled past as it went to the lowest level since 2017 on Thursday. A number of forces weighed on the metal. Copper rallied on Friday, so traders took heart. But when something sets lower lows, that’s usually bearish.

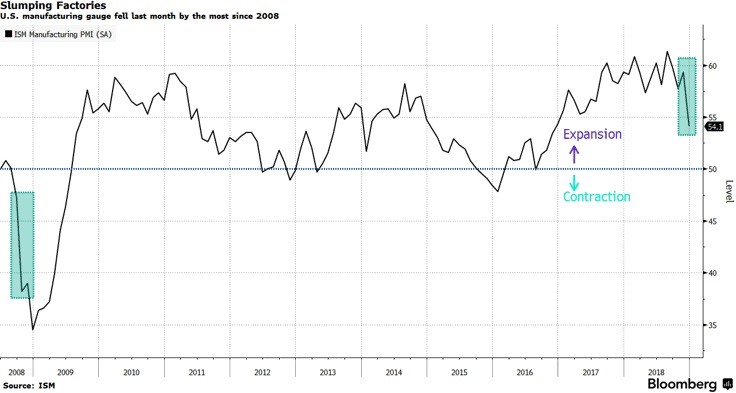

U.S. Manufacturing Gets a Wrench in the Gears

Closer to home, American manufacturing slumped last month by the most since 2008. And in absolute levels, ISM’s main manufacturing index dropped from 59.3% in November to 54.1% in December — its lowest level since November 2016.

Source: Bloomberg

The 5.2-point drop in one month in the U.S. factory index has been exceeded just twice this century, both times during recessions.

One Final Note: D.C.’s 3-Ring Circus

What do you call a country without a functioning government? The USA! Senator Chuck Schumer came out of a meeting with President Trump on Friday, saying that President Trump is in no hurry to stop the deadlock that shut down one-fifth of the U.S. government.

President Trump “said he’d keep the government closed for a very long period of time — months or even years,” Schumer revealed.

We shouldn’t be surprised. In a Cabinet meeting on Wednesday, President Trump said he’ll keep the government shutdown “as long as it takes” to get funding for his border wall.

Mr. Trump said: “I mean look. I’m prepared — I think the people of the country think I’m right. I think the people of this country think I’m right. Again. I could’ve done nothing. I could’ve had a lot easier presidency by doing nothing. But I’m here, I want to do it right.”

No matter which side of the border wall debate you’re on, if you think a continued shutdown won’t add to the country’s economic and market woes, you aren’t paying attention. “Who needs the government anyway?” is an easy line when all the “essential” employees still work without pay. We can’t count on that.

I think we should take President Trump at his word on this. And that means the shutdown could for a very long time. That’s another bearish force for the market to deal with.

Alternately, President Trump could declare a national emergency to try and use military funds for the border wall. He’s talking about that, too.

Even though the S&P 500 surged 3.4% in Friday’s trade, bookended by a 3.3% gain in the Dow Industrials and 4.3% in the Nasdaq, that doesn’t mean the bear is backing off. It’s up days like these when you want to load up for the next time the bear roars.

My Supercycle Investor subscribers recently banked a bunch of bearish gains. (To the tune of 127% and 120% in two rounds of Morgan Stanley puts, plus 8.5% in a quick bet against tech stocks and another 4.5% betting against small-cap stocks.) Plus, we’re sitting on several nice rounds of open gains in gold. And our latest bearish bet is up 2.1% in two days despite Friday’s big rally! Don’t wait — get in before the market’s next big move >>

All the best,

Sean